Fire Hazard in the Heart of LA: The Link Between Urban Oil Wells and Wildfires

Before We Blame Climate Change, Let’s Investigate the Role of Urban Oil Wells in LA Fires

As someone who had lived in Hawaii and saw the devastation of Lahaina by the fires in Maui in 2023, I have been watching what is happening in Pacific Palisades in California as a repeat of this horrific scene. The experience of seeing homes, wildlife, and landscapes destroyed by fire can leave lasting emotional scars, especially when the scale of destruction is so overwhelming.

I have heard a lot about what has fueled the fires from drought conditions, to downed power lines, dry vegetation and high winds. However, I have not seen much about how the fires had started.

Los Angeles’s long, troubled history with urban oil drilling

Los Angeles had oil wells pumping in its neighborhoods when Hollywood was in its infancy, and thousands of active wells still dot the city.

Over a century ago, the first industry to boom in Los Angeles was oil. Oil rigs were so pervasive across the region that the Los Angeles Times described them in 1930 as “trees in a forest.” Located in the fastest-growing metropolitan area of the country, oil development radically changed existing land-use patterns, encouraged industrialization and contributed to real estate speculation in the region.

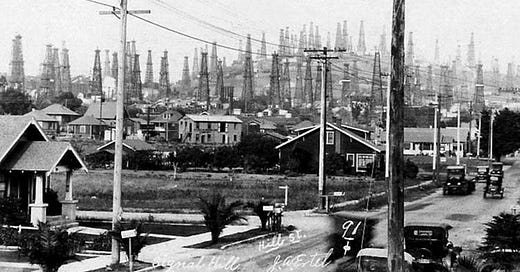

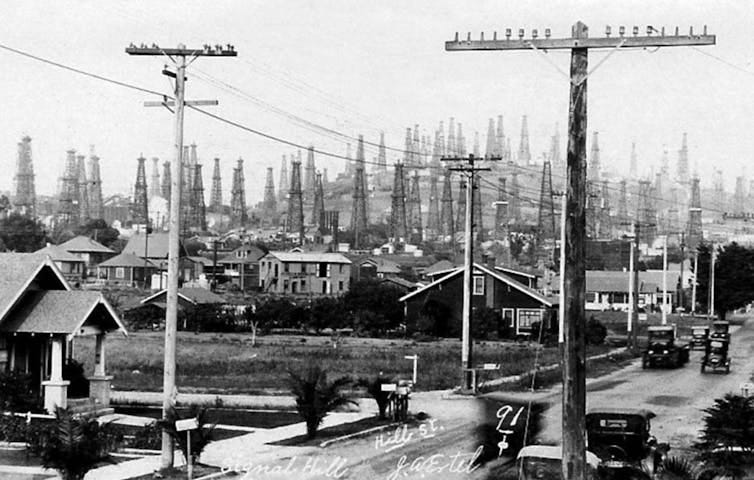

A 1924 photo shows the oil derricks on Signal Hill. Water and Power Museum Archive

Tensions over land use, extraction rights and subsequent drops in oil prices due to overproduction eventually resulted in curbs on drilling and a long-standing practice of oil companies’ voluntary “self-regulation,” such as noise-reduction technologies.

Increasingly, oil companies disguised their activities with approaches such as operating inside buildings, building tall walls and designing islands off Long Beach and other sites to blend in with the landscape. Oil drilling was hidden in plain sight.

Occidental Petroleum disguised this drilling site at Pico and Cardiff as a synagogue in 1966. Rebuilt in 2001, the pseudo-shul (now the property of Pacific Coast Energy) is home to 40 wells, which are accessed by a movable derrick that taps the same oil field as the Tower of Hope.

Named the “Tower of Hope” in 2000, it is a 165-foot derrick at Beverly Hills High and clad in a vinyl, sound-absorbing sheath festooned with flowers painted by hospitalized children.

The city is dotted with thousands of abandoned wells that continue to expose people to toxic gases

About one-third of residents live less than a mile from an active well site, some right next door. The city of Los Angeles has no buffers or setbacks between oil extraction and homes, and approximately 75% of active oil or gas wells are located within 500 meters (1,640 feet) of “sensitive land uses,” such as homes, schools, child care facilities, parks or senior residential facilities.

Idle wells have not produced oil in at least two years, and many have not been properly plugged. Estimates show it can cost more than $180,000 per well. If not plugged and cleaned up, many of these orphaned wells will continue to expose people to toxic gases, complicate redevelopment and pose rare but serious threats of explosions.

Source: https://aoghs.org/old-oil-stocks/conejo-hills-oil-company/amp/

"One of the big problems is that idle wells can leak," energy finance analyst Clark Williams-Derry said. "They can leak gasses like methane and some other gasses that can cause health and safety hazards to people who live nearby."

Clark Williams-Derry says there are more than 40,000 idle wells in California. A majority of these are located in the LA area as shown on the map below.

All Roads lead to Blackrock

Occidental Petroleum Corp (stock ticker symbol and logo OXY) was founded in Los Angeles, CA in 1920. Oxy is an American company engaged in hydrocarbon exploration in the United States and the Middle East as well as petrochemical manufacturing in the United States, Canada, and Chile. In September 2014, Occidental moved its headquarters to Houston, Texas and separated its California assets into a new company called California Resources Corporation (CRC), the largest producer of oil and natural gas on a gross-operated barrels of oil equivalent basis in California.

California Resources Corporation has many shareholders, including institutional owners, insiders, and interest owners. Some of the largest institutional shareholders of CRC include BlackRock, Inc., Canada Pension Plan Investment Board, Vanguard Group Inc, Gimbel Daniel Scott, and First Trust Advisors Lp.

Is this going to be another land grab?

Blackrock, a high-powered global investment company, has been buying up entire neighborhoods of single family homes and converting them into rental properties, pricing families out of the dream of home ownership.

Source: https://www.foxnews.com/media/blackrock-investment-firms-killing-dream-home-ownership

Blackstone started Invitation Homes in 2012 to buy houses in the wake of the foreclosure crises. Blackstone (BX) became the third-largest institutional investor in single-family houses in May 2024 when it acquired 37,478 of them by buying Tricon Residential (TCN) for $3.5 billion or $11.25 per share. That brought Blackstone’s inventory of houses to 61,964.

Blackstone has strategically capitalized on the affordable housing crisis to bolster its profits and has been aggressively acquiring residential properties, especially in regions facing acute housing shortages like San Diego. Blackstone has been on aggressive buying spree since 2021, expanding its residential real estate empire, adding over 256,000 units to its portfolio. Blackstone is by far the nation’s largest landlord, owning almost 350,000 units of rental housing in the U.S., and many more around the world.

“The goal of institutional investors like Blackstone is to optimize profits,” the Tablet article said. “On the ground, that translates to maximum allowable rent increases, evictions, the rise of hidden fees, a reduced investment in complex maintenance, and even efforts to influence state and local housing policy.”

Blackstone started BlackRock as an asset management company in 1988 and spun it off as a separate entity in 1992. BlackRock insists on its website that it buys only multifamily housing.

“While it is true that [BlackRock] does not own houses or own companies that own houses, they do invest in companies that own houses.” Blackrock owns 6.7% of American Homes 4 Rent (AMH), for example, which controlled 59,000 homes in the United States as of December 2023.

By 2030, institutional investors are estimated to own over 40% of all single-family rental homes nationwide.

In February 2024, Assemblymember Alex Lee introduced AB 2584 to protect California’s limited supply of single-family homes, and ensure that residents have the opportunity to become homeowners. The legislation proposed to prevent institutional investors that own more than 1,000 single-family homes from purchasing additional properties and converting them into rentals. The bill had passed the California State Assembly and is now in the state Senate.

All this to say that institutional investors now have an opportunity to purchase large swaths of land in the fire ravaged area should residents not wish to rebuild or are unable to rebuild due to lack of insurance coverage. Rumors are that corporations have already been calling and offering money to homeowners for their burnt out properties.

And this article came out just the other day giving advice to homeowners on how to sell a fire-damaged home in Los Angeles.

Tensions between oil producers and government have recently escalated

In a unanimous vote on Jan. 24, 2023, the Los Angeles County Board of Supervisors voted to ban new oil and gas extraction and phase out existing operations. It followed a similar vote by the Los Angeles City Council a month earlier. The city set a 20-year phaseout period, while the county has yet to set a timetable.

A new law signed by Governor Gavin Newsom in September 2024 increased the fees well operators must pay for their idle wells. The fees range from $1,000 to $60,000 per well per year. These fees are less expensive than the cost to cap them so, "In California, companies can essentially avoid plugging their wells by paying fees, and those fees allow for delay and allow companies to sort of kick the can down the road," Williams-Derry said.

In November 2024, the owner of an oil field in Los Angeles County filed a lawsuit against the state of California over a law that will require it to stop production and plug its wells or face costly fines.

Inglewood Oil Field owner Sentinel Peak argues in the lawsuit that the law, signed in September by Gov. Newsom, is unconstitutional. Attorneys for Sentinel Peak argue that the law “represents an illegal attempt to coerce an individual company to stop operation of its legal business,” according to court documents. They allege that mandatory fines, in particular, violate federal and state laws forbidding excessive fines.

Not to mention on the same day the fires started Biden signed an order banning offshore drilling. In a statement, Newsom highlighted that “hundreds of miles of California’s iconic coastline is now fully protected from expanded offshore drilling,” crediting Biden’s action as a boon for “generations to come.”

Conclusion

In conclusion, while the true cause of these devastating fires remains uncertain, it's clear that speculation will continue until concrete evidence emerges. Authorities may look for quick answers, potentially pointing to climate change or other factors such as homelessness, but none of these explanations fully account for the complexities of the situation. Even though a suspected arsonist was briefly in custody, the absence of evidence raises more questions than answers. The theory that the Palisades Fire may have been sparked by a rekindled blaze from New Year’s Eve adds another layer of mystery to an already tragic event.

Regardless of the ultimate cause, one thing is clear: there were preventive measures that could have reduced the risk and minimized the destruction. As we wait for answers, our focus should remain on supporting those who have lost so much—homes, businesses, and loved ones. For now, the hope is that this tragedy can serve as a catalyst for greater vigilance and action in safeguarding communities from future disasters.

This tragic event should also serve as a wake-up call for everyone to have a comprehensive plan in place in case of a fire. It's essential to establish clear exit routes, identify a safe meeting location for family members, and ensure that a go-bag is packed and ready at all times. In times of crisis, every second counts, and being prepared can make all the difference. Take the time now to decide what important items you would need to take with you if you had to evacuate quickly—important documents, medications, valuables, and any necessary supplies. Being proactive and planning ahead can provide peace of mind and help protect you and your loved ones when every moment matters.

Black Rock are behind a lot of dodgy things. From the forementioned property buying to prolonging the Ukrainian war. .

Also , I watched a vid of there CEO saying they will force people/ companies to do what they want and push through there agendas.

This company needs to be broken up and prosercuted where possible.

I grew up in this area and can confirm oil derricks could be seen around SoCal for many years when I was a kid and even into college. In fact interesting fact was that gas was cheaper in Huntington Beach/ Long Beach and I always wondered why (in college I would go there purposely to get cheaper gas). I was always told there was a refinery local there. Everything about the state is a mess. Left 2y ago and probably will not go back. After they cordoned off parks and removed slides from parks when kids were trying to play during covid that was enough for me to see the place has gone bonkers…my favorite story was when they filled a skate park with sand to keep kids out during covid and all these kids went and dug it out. Covid policy in CA is no different than the rest of their policies…like having a police officer drive out to the middle of nowhere trail in the mountains on a hike during covid just to tell me the trail was closed because of covid. People are not a priority there but they are glad to get your 13.5% in state taxes…plus melloroos plus HoA plus property tax…